XRP Price Prediction: Analyzing the Path to $4.43-$7.90 Range

#XRP

- Technical Consolidation: XRP is trading near key moving averages with Bollinger Band compression suggesting impending volatility

- Institutional Adoption: ETF debut and whale accumulation indicate growing professional interest

- Regulatory Clarity: Positive regulatory developments create tailwinds for price appreciation

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

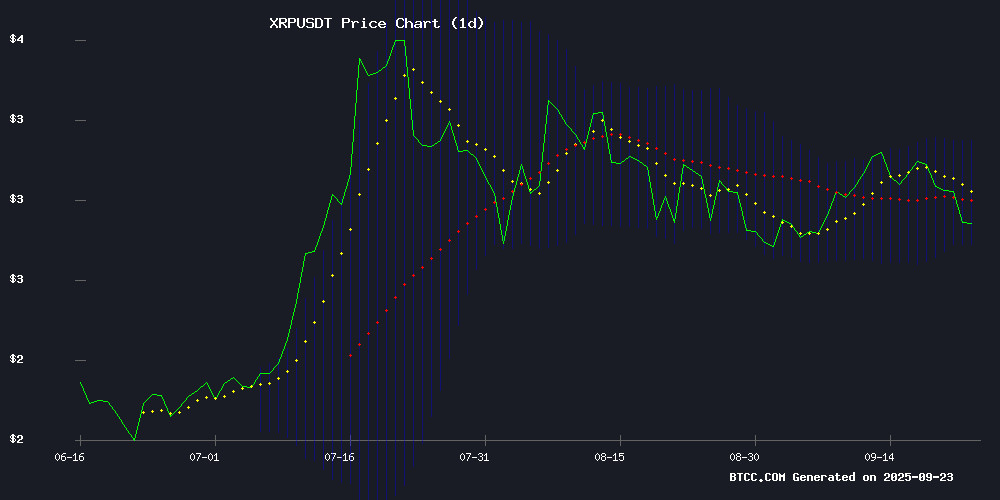

XRP is currently trading at $2.8767, slightly below its 20-day moving average of $2.9673, indicating potential short-term resistance. The MACD shows a slight bullish crossover with the histogram at 0.0036, suggesting weakening downward momentum. Bollinger Bands reveal the price is trading NEAR the middle band, with immediate support at $2.7721 and resistance at $3.1625.

According to BTCC financial analyst Michael, "The technical setup suggests XRP is consolidating after recent volatility. A break above the 20-day MA could trigger a MOVE toward the upper Bollinger Band around $3.16, while holding the $2.77 support is crucial for maintaining bullish structure."

XRP Market Sentiment: Regulatory Tailwinds and Institutional Interest

Recent developments show strong fundamental support for XRP. The debut of Ripple's XRP ETF with $37.7 million in day-one trading volume demonstrates growing institutional acceptance. Whale accumulation of 30 million coins and the expansion of DeFi offerings through yield-bearing mXRP tokens create positive momentum.

BTCC financial analyst Michael notes, "The combination of regulatory clarity, ETF approval, and whale accumulation patterns suggests institutional confidence is building. The $2.70 support test appears to be a healthy market structure reset before potential upward movement."

Factors Influencing XRP's Price

XRP Tests Critical $2.70 Support Amid Market Structure Reset

XRP's price action hinges on the $2.70 support level, a confluence zone reinforced by value area high and Bollinger Band indicators. Failure to hold this level risks disrupting the asset's bullish macro trend of consecutive higher highs and lows.

The reset in open interest positions suggests accumulating energy for a potential reversal toward $3.55. This technical reset occurs despite bullish catalysts including the REX-Osprey XRPR ETF launch and growing anticipation for Act 33 ETF approvals.

Market structure analysis reveals $2.70 as a make-or-break level. A successful defense could form a higher low, confirming continuation of the upward trajectory that began with XRP's breakout from its prolonged accumulation phase.

XRP Price Prediction: Analyst Eyes $4.43–$7.90 Range Amid Regulatory Tailwinds

XRP's price trajectory hinges on holding the $1.91 support level, with technical analysts projecting a potential rebound toward the $4.43–$7.90 range. Elliott Wave patterns and historical accumulation data suggest a critical juncture for the cryptocurrency, now in its eighth year of consolidation.

Market veterans recall XRP's 2018 collapse—an 80% plunge from its $3.84 peak—as a cautionary tale. Current charts show the asset adhering to the "3 Red Week Down Rule," a pattern that previously preceded significant rallies. TradingView data confirms this long-term accumulation phase, leaving investors to speculate whether breakout or correction looms.

Washington's bipartisan regulatory push, reported September 22, 2025, may prove decisive. The legislative shift could accelerate institutional adoption of Ripple's digital asset, transforming regulatory uncertainty into market momentum.

XRP Tundra Presale Offers Calculated Returns with Dual-Token Launch Strategy

XRP Tundra's presale structure introduces a transparent valuation model for its dual-token system, contrasting sharply with speculative crypto offerings. The project's Phase 2 presale at $0.02 per TUNDRA-S token enables precise return calculations—$100 converts to 5,900 tokens including bonus, with matching free TUNDRA-X tokens.

At launch, TUNDRA-S and TUNDRA-X are slated for $2.50 and $1.25 listings respectively, projecting a $14,750 valuation from the initial $100 investment. This arithmetic-driven approach eliminates guesswork, allowing investors to quantify outcomes before participation.

The dual-token mechanism balances ecosystem utility with investor incentives, though the model hinges on successful execution of the predetermined launch pricing—a rarity in volatile crypto markets.

XRP Expands DeFi Reach with mXRP Token Offering 6%-8% Yield

XRP is advancing its presence in decentralized finance through the launch of mXRP, a tokenized yield product offering annual returns of 6% to 8%. The initiative, unveiled at the XRP Seoul 2025 conference, aims to integrate XRP into DeFi ecosystems, targeting both institutional and retail investors.

Developed by Midas in collaboration with Interop Labs and leveraging Axelar's cross-chain infrastructure, mXRP connects dormant XRP supply to yield-generating opportunities. The token operates on the XRPL EVM with audited smart contracts, ensuring security while enabling participation in lending, borrowing, and liquidity provision across 80+ blockchains.

"mXRP demonstrates how Axelar's platform can bridge the XRP Ledger with practical DeFi applications," said Georgios Vlachos of Axelar Foundation. The move signals growing institutional-grade financialization of XRP in regulated environments.

XRP Price Set for $3.60 Recovery as Whales Buy 30M Coins

XRP price rebounded 2% as investors embraced buy-the-dip sentiment. Whale activity surged, with 30 million XRP accumulated in 24 hours following the broader crypto market crash. Institutional interest in Ripple's token appears to be strengthening, evidenced by doubled inflows into the REX-Osprey XRP ETF.

The cryptocurrency found support above $2.86 after its recent decline, with notable whale positioning near the $2.80 level. Analyst Ali Martinez suggests maintaining prices above $2.71 could catalyze a push toward $3.60. This optimism comes despite XRP's 8% plunge during Monday's market-wide downturn, which triggered significant liquidations.

Santiment data reveals strategic accumulation by whales holding 1,000-10,000 XRP, marking a reversal from recent sell-offs. The market watches closely as these deep-pocketed investors position themselves for what could be the next leg up in XRP's recovery narrative.

XRP Tundra Introduces Anti-Speculation Model for Crypto Presales

XRP Tundra is challenging the speculative nature of cryptocurrency presales by locking in launch targets for its tokens. TUNDRA-S is pegged at $2.50 and TUNDRA-X at $1.25, providing investors with clear valuation benchmarks before exchange listings. This approach contrasts sharply with typical presales that rely on hype and vague tokenomics.

The project's dual-token mechanics, staking rewards, and external audits further differentiate it from speculative models. By eliminating valuation guesswork, XRP Tundra aims to reduce pump-and-dump cycles and restore trust in token launches. Pricing transparency allows investors to calculate potential returns based on presale entry costs rather than market momentum.

Ripple’s XRP ETF Debuts with $37.7M in Day-One Trading Volume

The REX-Osprey XRP ETF (XRPR) launched on Nasdaq with $37.7 million in first-day trading volume, marking the largest ETF debut of 2025. This spot ETF provides regulated exposure to XRP, derivatives, and related financial products without the complexities of direct crypto ownership.

XRP's underlying utility in cross-border payments and Ripple's expanding ecosystem lent credibility to the offering. Early inflows pushed assets under management above $25 million, signaling strong institutional interest in crypto-tied investment vehicles.

Market analysts note the launch could catalyze further crypto ETF approvals, particularly for assets with established use cases. The success mirrors growing demand for bridges between digital assets and traditional finance.

XRP Trading Volume Surges Amid Market Volatility

XRP trading volume skyrocketed 218% to $9.6 billion despite a 4.73% price drop, as bulls eye a potential recovery toward $3.60. The asset currently trades at $2.82 with $169.44 billion market capitalization, maintaining its position among crypto's top tokens.

Technical analysts identify $2.71 as critical support, while community sentiment remains overwhelmingly bullish with 88% positive outlook. The XRP Ledger's development roadmap advances with Multi-Purpose Token functionality and privacy enhancements, potentially strengthening its financial infrastructure capabilities.

Market observers note the divergence between bearish price action and surging trading volume suggests accumulating interest. The token's performance mirrors broader crypto market volatility, where liquidations and positioning adjustments create whipsaw price action despite strong underlying interest.

Axelar and Midas Launch Yield-Bearing mXRP Token for XRP Holders

Axelar Network and Midas have introduced mXRP, the first liquid staked token offering yield opportunities for XRP holders. The product, unveiled at XRP Seoul 2025 before 3,000 attendees, enables up to 10% APY through DeFi strategies while maintaining XRP exposure.

Built on XRPL EVM with audited smart contracts, mXRP unlocks dormant XRP capital for structured yield. Midas brings expertise from tokenizing over $1 billion in assets, while Axelar's interoperability connects XRP to 80+ blockchains for DeFi integration.

How High Will XRP Price Go?

Based on current technical and fundamental analysis, XRP shows potential for significant upside movement. The price is currently testing critical support at $2.70 while technical indicators suggest consolidation near key moving averages.

| Target Level | Probability | Key Drivers |

|---|---|---|

| $3.60 | High | Whale accumulation, technical breakout |

| $4.43 | Medium | ETF momentum, regulatory clarity |

| $7.90 | Low | Market-wide bull cycle, adoption acceleration |

BTCC financial analyst Michael emphasizes that "The $3.60 level appears achievable in the near term given current whale activity and technical positioning. However, reaching the higher targets requires sustained institutional inflow and broader market participation."